The student loan system is broken. For the crime of pursuing a higher education, many graduates in England face an additional 9% marginal tax for most of their working lives. Alec Haglund, IF Researcher, discusses IF analysis of the best ways to lower the debt burden for graduates.

Reform is necessary

Since the introduction of the income-contingent tuition fee system, graduates have had to pay an additional marginal tax of 9% for 30 years if earning over a threshold of repayment. Recent changes to the system mean that new students will face that same high marginal tax rate but for an extra decade. Unfortunately for young people and future generations, Labour also announced a u-turn on their promise to abolish tuition fees.

Those who entered higher education in 2012 or later are on Plan 2 student loans and currently face 30-year repayment terms. Due to high interest rates, both when students as well as after graduating, less than a quarter of graduates will pay off their student loans in full, meaning that graduates face an extra marginal tax of 9% into their fifties.

Under the new system (Plan 5), the threshold for repayment will be reduced from £27,295 to £25,000, and the repayment term will increase from 30 years to 40 years. A minor win for Plan 5 students is that interest rates will align with the Retail Price Index (RPI), in contrast to Plan 2 interest rates which are RPI+3%. While less interest will be added to students’ accounts, such action also acts as a regressive reform. It means that low- and middle-income graduates will see their lifetime payments double, while high-earning graduates will see their lifetime repayments almost halved.

Long repayment terms and high repayment rates hurt low- and middle-income graduates

Previous IF research showed that the current system is far from progressive. It unfairly punishes low- and middle-income graduates while the wealthiest 10% of students are able to pay tuition fees upfront and can therefore completely avoid the additional tax other less fortunate graduates must pay.

Those with student loans and high incomes can pay off their loans relatively quickly. Therefore, it is graduates with low or average incomes who suffer the highest financial burden, as they end up paying much more in total than their wealthier counterparts.

What can be done?

Many young people are already in a precarious financial position due to the cost-of-living crisis, unaffordable private rents, and falling real wages, leaving very little at the end of the month, if anything, that can be saved for the future. The 9% additional marginal tax for graduates (or 15% for those with a Master’s degree) is a significant component of the financial squeeze young people are facing.

Although the ultimate goal must be to abolish tuition fees and finance higher education through progressive taxation, there are other measures that could make a considerable contribution to improving the financial situation of low- and middle-income graduates.

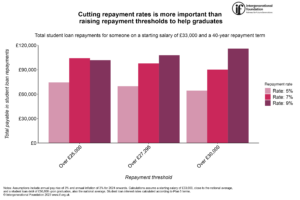

The best way to help graduates is to lower the rates of repayment. However, if it is not a substantially lower rate at 5% or less, then it should be done in conjunction with increasing the repayment threshold and shortening the repayment term. As shown by the graph below, cutting the repayment rates to 5% (or lower) is the best way to avoid graduates on 40-year Plan 5 loans having to pay over £90,000 in lifetime repayments.

Both graphs in this article have been produced with the assumption that a graduate has the average amount of student loan debt upon graduation (£50,800), a starting salary close to the national average salary of £33,000 with an annual increase of 3%, and annual inflation of 3% beyond 2024. Additionally, the analysis assumes that the threshold of repayment does not change. Although it is unlikely that the threshold would remain the same throughout the repayment period, it is also difficult to predict what future governments will do with regards to changing the thresholds, since successive governments have used secondary legislation to freeze, raise or lower them.

As the graph above reveals, lowering the repayment rate to 5% would have a drastic effect on lifetime student loan payments for graduates. Lowering the repayment rate to 7% would also be beneficial, but mainly in conjunction with increased repayment thresholds. It means that someone with a repayment rate of 7% and a threshold of £30,000 will have slightly higher total repayments than someone with a repayment rate of 9% at the same threshold. This is due to the person on a 9% repayment rate clearing their debt after 37 years due to having had more of their salary deducted in student loan payments, while the person on a 7% repayment rate does not clear their debt.

Indeed, the only two scenarios in which the debt would be cleared under these assumptions would be with a 9% repayment rate and a threshold of £25,000 or £27,295, in which case the debt would be cleared after 37 and 39 years, respectively.

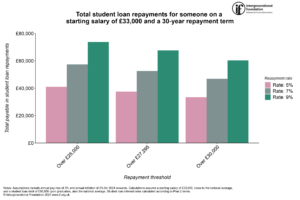

Despite the lifetime repayments being much lower for those on 30-year terms in comparison to those on 40-year terms, the total sums are still sky-high, as the graph below shows.

As can be seen in the graph, the shorter repayment term of 30 years leads to significantly lower lifetime repayments for graduates in comparison to those on 40-year repayment terms. Even if the lifetime repayments remain high, we can see that the impact of lowering repayment rates and raising the threshold has a larger impact when the repayment term is shorter.

However, even on a 30-year repayment term, many low- and middle-income graduates will have to pay up to £70,000 in lifetime repayments according to current terms, or even more in some instances. This is unfair, as the wealthiest who can pay fees and living costs upfront and avoid interest altogether or those with very high starting salaries end up paying much less in total. Only by lowering the repayment rates can the lifetime payments for low- and middle-income graduates on a Plan 2 style loan be significantly reduced. Therefore, we urge this government and future governments to lower the repayment rates and increase the repayment threshold for those on Plan 2.

Where next?

Whichever party offers tangible and substantial improvements to the punishing system of student loan repayments is likely to attract swathes of young voters desperate for change. Even if neither major party is willing to completely abolish the tuition fee system or write off student loans, there are other policies that would help current and future graduates.

Firstly, the immediate rescinding of the increase in the repayment term from 30 years to 40 years. The repayment term increase is highly regressive and means that low-and middle-income graduates would have to pay a significant part of their income towards their student loan well into their sixties.

Secondly, the repayment rates should be significantly lowered for both current and future graduates. High repayment rates punish low- and middle-income graduates the most due to not being able to pay the loan off in full even with high repayment rates.

Thirdly, and at a bare minimum, policy-makers should commit to annually increasing the repayment threshold in line with inflation. The current threshold has been frozen for many years, which in effect is a graduate tax increase due to inflation by using “fiscal drag”. The plan to move to a lower threshold of £25,000 is the opposite to what we need to do. Instead, the government should raise the threshold to £30,000 and increase it annually in line with inflation.

Help us to be able to do more

Now that you’ve reached the end of the article, we want to thank you for being interested in IF’s work standing up for younger and future generations. We’re really proud of what we’ve achieved so far. And with your help we can do much more, so please consider helping to make IF more sustainable. You can do so by following this link: Donate.