As the housing crisis continues to get worse, those stuck in the private rental sector are suffering from increasingly unaffordable rents. Alec Haglund, IF Researcher, discusses why a growing proportion of young renters are financially vulnerable, and why the government must do more to help them.

Skyrocketing rents have become the new normal

As fewer and fewer young people can afford to purchase their first home, this means that more young people are stuck in an increasingly unaffordable private rental market.

The rental crisis is a national crisis. Average rents in the UK increased by 10% year-on-year in September 2023, with Hamptons estate agents predicting that rents will rise by another 25% over the next three years. Meanwhile, average rents in some London boroughs have increased as much as 20% in a year, and it is not uncommon to hear stories of landlords putting up rent by as much as 40% in the capital.

This situation will clearly put a significant financial strain on renters across the UK, since the very fact that they are renters suggests that they are unlikely to have been able to save much. Saving is very difficult for those in the private rental market as rental payments eat up an increasing part of the monthly paycheck. In fact, some data sources suggest that the average UK tenant must spend 39% of their income on rent.

Renters are over-represented among the financially vulnerable

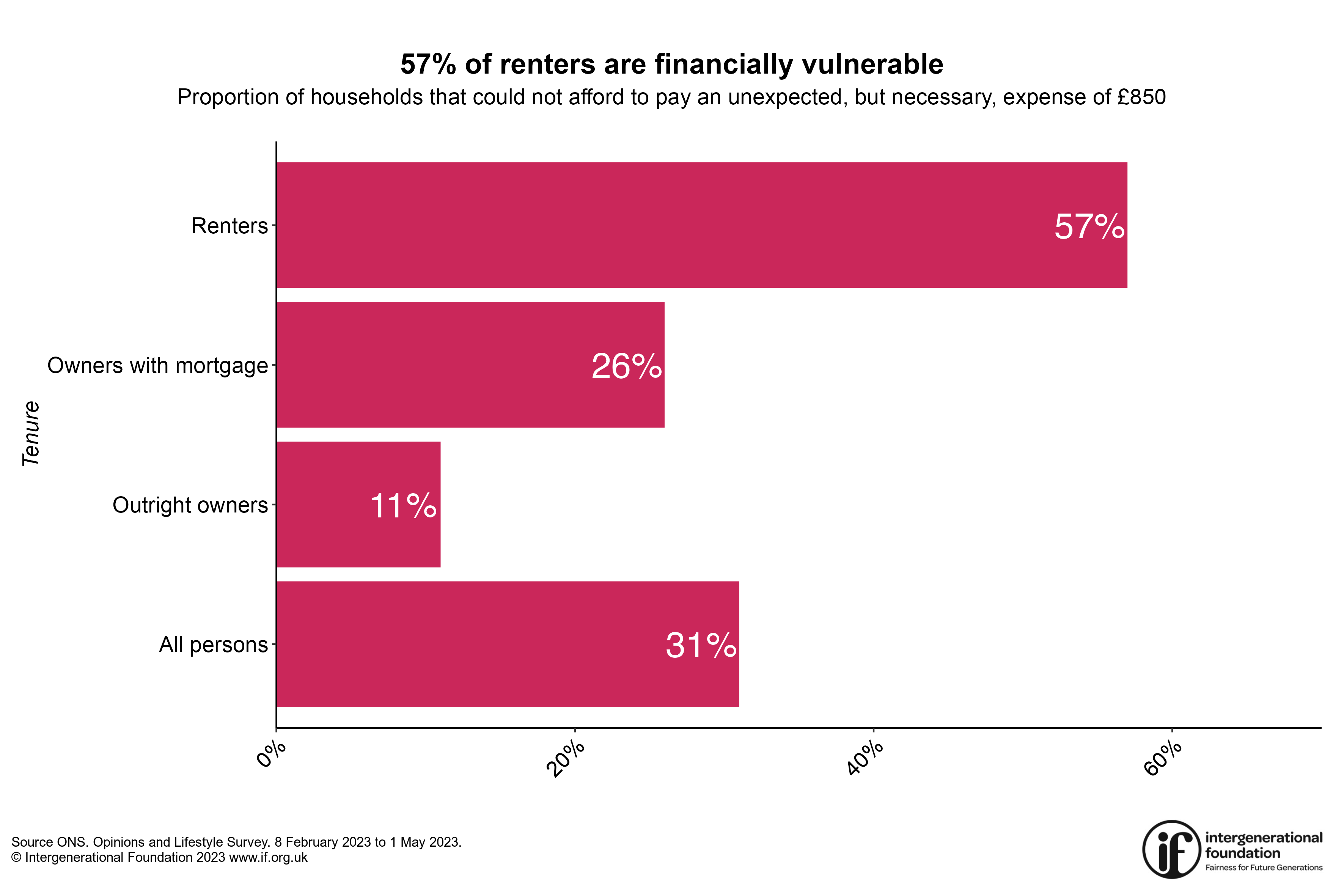

It is unsurprising to find then that more than half (57%) of renters would not be able to afford an unexpected, but necessary, expense of £850. Being unable to meet an emergency payment demand can be seen as a proxy for financial vulnerability. This figure stands in stark contrast to homeowners, since only 11% of outright owners and 26% of owners with a mortgage would be unable to pay the £850 expense.

The proportion of renters who cannot afford an unexpected expense of £850 pounds has increased by seven percentage points in just one year; the figure stood at 50% in the spring of 2022. This reflects the financial pressure renters have been facing due to the cost-of-living crisis, falling real wages, and the rise in rents. Given the current tenancy insecurity that renters face, it is worrying that so many renters could not afford an unexpected expense of £850, since a deposit for a new tenancy, which must often be paid before a previous rental deposit is returned, is likely to cost more than that figure in many regions of the UK.

An imbalance of power

Successive governments have failed to tackle the rental crisis, which has led to a situation where the interests of landlords have been prioritised above the needs of young renters who need an affordable and secure place to live.

The Renters’ Reform Bill would offer some welcome, albeit watered-down, improvements to the imbalance of power between renters and landlords. However, the Bill does not go far enough to improve the abysmal situation in which renters find themselves. Additionally, the Bill has repeatedly been delayed due to the self-interest of legislators who themselves are landlords. Research suggests that MPs are nearly four times more likely to be landlords than average citizens, with almost 20% of MPs in the governing Conservative Party earning rental income.

The Renters Reform Bill does not go far enough

The Bill was already far from transformative in its original form, and many key parts of the Bill have since been scrapped. For example, legislators scrapped the need for landlords to upgrade the energy efficiency of their rental properties, which will mean that renters will continue to have to find billions of pounds in energy costs due to badly insulated properties.

The ban on no-fault evictions has been postponed, and when or if it finally does become law, it will instead be replaced by various new grounds for eviction that landlords can use instead. And, even if no-fault evictions were banned, landlords would still be able to effectively evict their tenants through rent increases which they cannot afford.

Furthermore, there are no limits on how much rent can be increased, and little recourse for existing tenants to fight annual double-digit rent increases. As a result, newspapers cite rental index rent increases of more than 20% in the last two years with some tenants facing annual rent increases of 30% or even 40%.

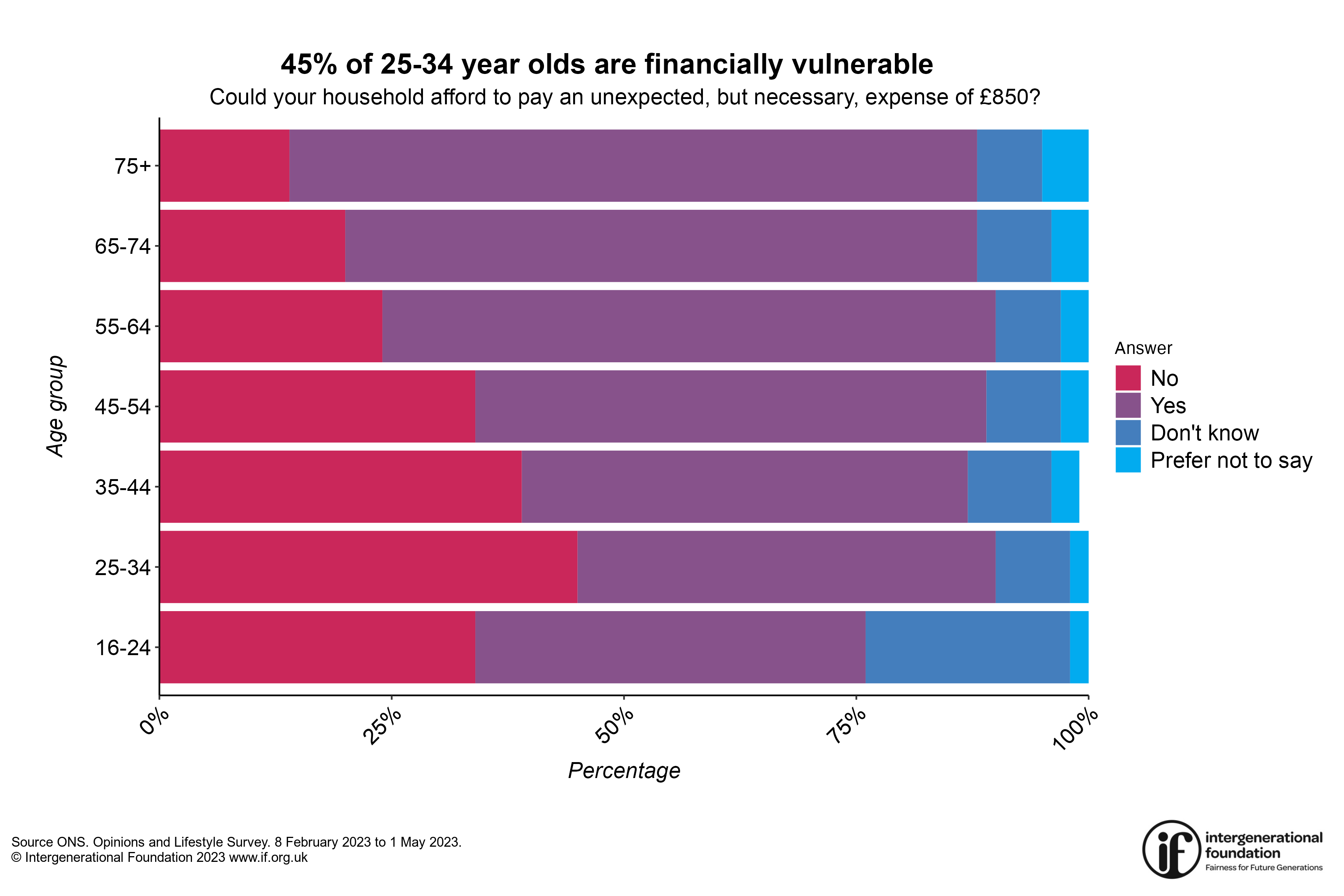

Many young people cannot afford an unexpected but necessary expense

Since many young people are renters, it is hardly surprising that many young people are characterised as financially vulnerable. As the graph below shows, 45% of people aged between 25 and 34 years would not be able to pay an unexpected, but necessary, expense of £850 in 2023.

What can be done?

The rental and housing crisis in the UK has many roots and shows itself in different forms. However, the key issue is that an economic view which views housing as an investment for profit rather than as a place to live has permeated policy. This view must be overcome.

Campaigning organisations representing renters have been calling for various policies, such as releasing green belt protections close to rail links, banning landlords from asking for multiple months of rent in advance and temporarily freezing rents, and building more social housing while ending right-to-buy. IF has long been arguing for the need to build more housing of all tenures, increase the rights of renters, address the issue of under-occupation, and reform the planning system, among other policy calls to improve the plight of renters.

The data is clear: young renters are struggling, and the government is not doing enough to fix the housing and rental crisis. If the current complacency continues, an increasing number of young people and renters will become financially vulnerable. We know that the policies listed above would help to fight the housing crisis, so it is only fair on younger generations that we continue to pressure policy-makers to reform the system as soon as possible.

Help us to be able to do more

Now that you’ve reached the end of the article, we want to thank you for being interested in IF’s work standing up for younger and future generations. We’re really proud of what we’ve achieved so far. And with your help we can do much more, so please consider helping to make IF more sustainable. You can do so by following this link: Donate.